Pay taxes online for individuals. How to pay taxes to an individual using an Inn without a receipt

If you have a need to check tax debts according to the TIN, this can be done in several ways, in particular, by conducting an online check of debts to the tax office. In most cases, a citizen can easily obtain information about his tax debts using the website of the Federal Tax Service by TIN, but in some situations, data on tax debts can be found only after receiving special access from the tax office at the place of registration.

In this article, we will introduce you to all the available ways to receive and verify tax debts.

Is it possible to find out about taxes and tax debt using the TIN?

An individual who pays taxes from time to time is faced with the need to find out information regarding existing tax debts, having at his disposal his TIN, such information may relate to:

- Overdue tax payments.

- Taxes that have been paid (to avoid having to pay again).

- Debts that were assigned for collection by the tax inspectorate, but in fact were not paid.

- Tax payments for which the payment deadline has not yet arrived (has not been overdue).

This information can be obtained online, having access to the Internet, or from the tax office located in your area. Information about various types tax debts, which can be identified by TIN, are posted on a number of government Internet resources, which we will discuss in this publication.

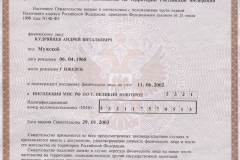

As a rule, tax debt can be found out and verified using the following information: full name and date of birth of the taxpayer; TIN (Taxpayer Identification Number); SNILS individual number from the certificate of compulsory pension insurance. In some cases, registration and receipt of an electronic digital signature (electronic digital signature) will be required, for example, for authorization on the State Services portal to access the database containing tax information.

On what websites can you check tax debts using your TIN?

As we have already mentioned, there are a number of government websites and portals where you can check tax debts using your TIN and full name. Now we will focus on the main Internet resources that contain tax information and allow you to access it online.

1. Federal Tax Service website - check tax debt using TIN

If you need to look up taxes online by TIN, then the first resource you should visit http://www.nalog.ru/ is the website of the Federal Tax Service of Russia -. On it, go to your “Personal Taxpayer Account for Individuals”. To get into it, you need to go to the main page and use the “Pay taxes” Menu item.

You should know that you can only log into your personal account using a password, which you can obtain from the territorial tax office. The taxpayer must write an application, on the basis of which the Federal Tax Service registers him on its website and issues a registration card - it contains information about how to use your personal account, as well as a password for accessing the tax database. The login to enter your personal account is the citizen’s TIN. This method makes it possible to find out the debt according to the TIN online.

After the user is registered on the site, after three days he will have access to his personal account. In addition, you must change the initially issued temporary access password within 30 days, otherwise you will have to obtain the password again from the tax office.

If you have lost (or simply do not have it) your tax registration certificate, then you should not worry, since you can find out your TIN on the website nalog.ru. To check which TIN is assigned to this or that to an individual You will need your passport details and full name. For an entrepreneur's TIN, the full name and region where he lives is enough.

2. FSSP website - check overdue tax debts

Information about debts that were overdue can also be obtained on the official website of the FSSP (Federal Bailiff Service).

Go to the official website of the FSSP http://fssprus.ru/ - find the tab “Wanted Register for Enforcement Proceedings” (see screenshot in the illustration), after which the necessary information will be available to you. There is no need to register on this site, and information can be obtained without a TIN. You only need to enter the first and last name of the debtor in the search column and select the required region from the list. If you need to obtain more accurate data, you should indicate the date of birth and full name.

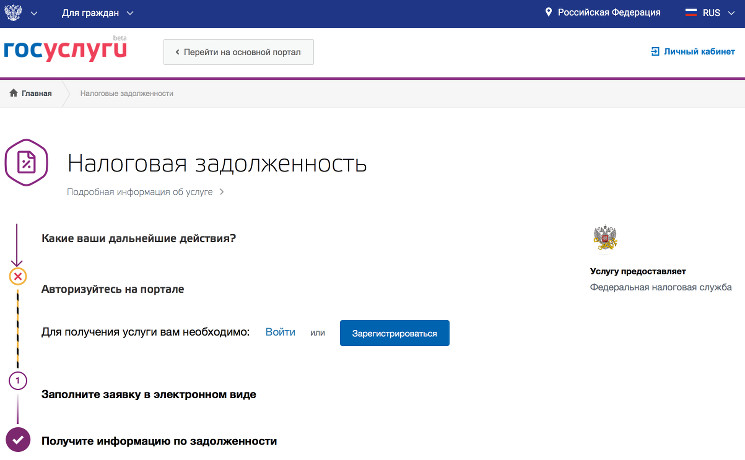

3. Unified website for government services - find out tax debts online

Information about tax debts can be obtained on another resource - a single portal public services. We go to the website gosuslugi.ru, find on home page tab “Tax debt of individuals” and click on it.

To obtain data on the EPGU portal (unified portal of public services), you must register. To complete this procedure, you must indicate your SNILS number and the following personal data:

- Full name;

- Date and place of birth;

- place of registration (at place of residence and place of stay;

- home phone;

- email.

Registration will be activated by SNILS number or phone number with via SMS(depending on the authorization method you choose, one or another set of functions will be available, for example, by registering a digital signature key you get access to all tools and functions single portal public services).

How to find out the amount of tax required to be repaid online using the TIN?

If you need to find out the amount of taxes for which the payment deadline has not arrived (or has not expired), then, as we have already discussed above, this can be done on the Federal Tax Service website by going to the “Taxpayer’s Personal Account”. The required information is located in the “Accrued” tab.

If you have paid a tax in advance for which the payment deadline has not yet arrived, then information about it will be in the “Overpayment/debt” column and until the payment deadline expires, the amount will be counted as an overpayment. When the deadline for payment expires, the amount will be moved to the “Paid” column.

Also, the information we described above can be obtained on the government services portal.

How to find out overdue tax debt using TIN?

If the taxpayer missed the tax payment deadline and needs to find out the amount of the tax debt that has arisen, then get necessary information You can visit the Federal Tax Service website by going to your Personal Account. Similar information can be obtained on the government services website. The debt will be recorded as “Debt” and information about it is available using the “Overpayment/Debt” column.

In the event that a taxpayer voluntarily does not pay debts, the tax office will collect them in court, and for this purpose the mechanism of a court order will be used. This scheme is a simplified legal procedure for which the presence of the taxpayer-debtor is not required. After this, the court order will be transferred to federal service bailiffs.

On the FSSP website you can find information about the so-called enforcement proceedings, which are cases for collecting tax debts in forcibly. This procedure is carried out by bailiffs. Data on enforcement proceedings contain the debtor’s place of residence, full name, judicial act (the basis for debt collection) and the amount of the debt.

How to check debt on transport tax and real estate tax?

On the Federal Tax Service website there is no difference between local and federal taxes. After some time (usually a few days), when information about the object of taxation appears in the inspectorate, in the “Personal Account” of the taxpayer in relation to this object (movable or immovable property), you can find the debt of an individual by TIN number. The tax amount can be checked when the tax accrual deadline for a given object comes.

If you need to find out property, transport taxes or the amount of real estate tax debt, then just click on the corresponding object - real estate, car, land.

To quickly check information about car tax (transport tax) on the government services portal, you can use the “add vehicle” function. To do this, enter the name, series and number of the vehicle registration certificate and the state number of the car in the appropriate fields.

Information about personal income tax is entered in a separate column, representing information about taxes paid at the place of work (2-NDFL), as well as according to the 3-NDFL declaration.

Let's summarize: checking your taxes by TIN online is not difficult if you register on the tax office website and then log into your personal account. Similar information can be obtained on the state portal. services. When registering, you will be required to enter personal data, after which this function will be available to the user.

If the debts are being processed by bailiffs, then the necessary information can be obtained on the FSSP website. In this case, no special access or registration is required.

Most banking services can now be obtained via the Internet. If you are a client of Sberbank of Russia, you have the unique opportunity to pay for any services through your personal account on the Sberbank Online website. Owners of plastic cards can use this service, and payment will be debited from your card account.

To the extent that every citizen of the Russian Federation is obliged to pay taxes, and, accordingly, to make a transfer you can use the remote service of Sberbank. Let's take a closer look at how to pay taxes through Sberbank Online. step-by-step instruction for taxpayers.

Everything here is quite simple, all you need is a computer or mobile device with Internet access, as well as a bank card with an available amount in the account. In addition, you will be required to provide a receipt and payment details using which you will make the payment.

Please note that you can send payment both in the browser version of the service and in the mobile application.

So below we will look different ways, pay taxes through Sberbank Online, step-by-step instructions will be presented below. It is worth focusing your attention on the timing of tax payment; funds must be paid within the deadlines established by law; for each tax: property or transport there is a payment deadline. If you do not have time to pay the tax, you will have to pay a penalty, otherwise bailiffs will collect the debts, and the amount of the contribution will be much higher.

How to make a payment

Step-by-step instructions for paying tax will depend primarily on whether or not you have a receipt. Basically, the Federal Tax Service sends receipts for payment to the taxpayer’s registered address, but there are a number of reasons why you did not receive it. But first, let’s look at an example with a receipt.

So, first you need a personal account on the bank’s website, if you have not registered it, then first you should do this, after which you will be able to use all the services of this system. Let's look at an example of how to pay transport tax through Sberbank Online:

open your account;

- go to the payments and transfers section;

- open the link “State traffic police, taxes, duties, budget payments»;

- you need the section “Search and payment of taxes to the Federal Tax Service”;

- you can send payment in another way, by receipt, for this you find the item “Select a service”, click on the line and select the section “Payment of tax by document index”;

- then you take the receipt and on the top line you find the document index and enter this number in this field;

- After this, you will see the payment details and the amount to be paid;

- check the details and confirm the transaction with the password from the SMS.

So, you can pay your car tax through Sberbank Online. By the way, if for some reason you did not receive a receipt or lost it, then you can take a copy at any time to the Federal Tax Service office at the place of registration of the taxable object, that is, real estate or a vehicle.

Payment without receipt

It also happens in life that you do not have a receipt and you are not able to get it, for example, the property is registered in another region. But no circumstances will exempt you from paying tax. You can also do this through your account:

- first you need to log into your account and follow the links to the section “Search and pay taxes to the Federal Tax Service”;

- after that, find the item “Select a service” in the form to fill out;

- open the list and select “Search for debt by payer’s TIN”;

- then enter your TIN number and click “Continue”;

- the service will find all outstanding payments, and you can pay them immediately.

If you do not know the TIN, you can obtain information on the Federal Tax Service website using your passport.

So, you can pay your property tax online at any time convenient for you. In addition, you can print a receipt if you need it and you can rest assured that this method is reliable. The only caveat is that it is worth sending the payment in advance, because the payment deadline may be delayed by up to 5 days.

Non-payment of taxes is a serious violation, fraught with penalties and fines. But it is not always possible to make payments on time due to excessive busyness or other reasons.

Can you pay taxes online in 2017? Every taxpayer is required to pay taxes on time.

But sometimes a simple lack of time does not allow you to visit the tax office or bank on time to make a payment.

And sometimes, in the daily rush, paying taxes is first postponed and then conveniently forgotten. The result is receiving a request from the tax office to pay the tax, as well as accrued penalties and fines.

You can prevent such troubles by paying your taxes on time. Moreover, in 2017 this can be done without leaving home, using online resources.

Important points

The appearance of the consolidated tax notice from the Federal Tax Service has been approved. According to the KND, this form has the index 1165025 and it came into force on April 1, 2017.

The received tax notice may include four tax obligations at once:

- by, if the tax was not previously withheld by the tax agent;

But the Federal Tax Service includes in the notification only those taxes for which the taxpayer has or has incurred an obligation to the budget.

Therefore, the notification may come in an expanded form or in a truncated form. The principle here is that if there is no object, then there is no tax.

In 2017, a consolidated notification may come not only for the previous 2016, but also for previous tax periods.

The limit period is three previous years, not counting the current one. Additional tax assessments may occur as a result of recalculation of tax amounts.

A consolidated tax notice is generated using special computer programs V automatic mode. This doesn't mean there can't be mistakes.

Therefore, when receiving a notification from the tax office, you need to carefully study the source data specified in the document and the correctness of the calculations.

Where should the notification go? By general rule The document is sent to the taxpayer's registration address.

If the taxpayer has a personal account on the official website of the tax authorities, he will receive the notification in electronic form.

Since June 2, 2016, there has been an innovation () that when an individual connects to his personal account on the Federal Tax Service website, sending tax documents to the registration address by regular mail is automatically canceled.

Regardless of the type of notification, paper or electronic, taxes are allowed to be paid by any available means. And the most convenient way is to pay online.

Required terms

Tax is a mandatory payment that individuals and legal entities are required to pay. The purpose of gratuitous collection is to provide financial support for government activities.

The obligation to pay established taxes and fees is fixed. Taxes are the financial basis and a necessary condition for the existence of the state.

Therefore, the obligation to pay taxes applies to all taxpayers, being an unconditional requirement.

Who is the taxpayer? All legal entities, as well as individuals, receiving taxable income and owning property subject to taxation.

That is, in fact, a taxpayer is any citizen who works officially and has at his disposal certain property (transport, real estate).

Failure to pay taxes on time will result in a fine, the amount of which depends on the type of tax and the period of delay.

In addition, for each day of delay, a penalty is charged on the amount of the debt. Long-term failure to pay tax debts can cause very unpleasant consequences, ranging from bills to confiscation of property.

Types of penalties

What taxes should a taxpayer who is an individual pay? There are several types of tax fees for ordinary citizens. This:

| or personal income tax | This is a federal tax that is paid on all income of citizens in the past year, received in cash or in kind. The personal income tax rate for tax residents of the Russian Federation is 13%. Tax on wages is collected and paid by the employer. On other income, tax can be paid by tax agents or by citizens themselves. |

| Local tax paid to the municipal budget if there are residential and non-residential premises in the property. The tax amount is calculated based on the cadastral value of the objects | |

| Refers to local taxes paid to the budget of the municipality where the land is located. Land tax is calculated based on the cadastral value. The tax rate is set by regional authorities no more than 1.5% | |

| Regional tax paid to the budget of the constituent entity of the Russian Federation where transport is registered. The tax is calculated based on the characteristics of the vehicle |

Regulatory regulation

In some cases, the responsibility for calculating taxes rests with the tax agent and tax authorities.

The tax is paid in a lump sum within a certain period of time or in another manner provided for by tax and civil legislation.

The information will be sent to the user's personal account. You can also set up notifications to display debt information on the portal home page.

And if you install mobile app from State Services, then information about debts will be received in real time.

Important! If a taxpayer knows that he has overdue tax debts, then information can be obtained on the FSSP website.

Overdue payments are sent to the bailiff service for enforcement.

When is payment due?

The deadlines for payment of property taxes (transport, land, property tax) are determined.

Payments must reach the budget no later than December 1 of the year following the previous year in which the tax liability arose.

These taxes are paid after receiving a tax notice from the Federal Tax Service. The deadline for receiving such receipts is 30 days before the due date.

In this case, an individual pays taxes for no more than three previous tax periods. If the taxpayer has not received the notification, then he is obliged to inform the Federal Tax Service about the presence of taxable objects before December 31 of the year of payment of the tax.

Failure to notify the tax office may result in a fine of 20% of the unpaid tax amount.

Before contacting the Federal Tax Service, you must check the availability of the corresponding tax notice in electronic form (in the taxpayer’s account, by email).

Full name is indicated here. taxpayer, TIN, required tax, amount, registration address according to the passport. For online payment, you should choose non-cash payment.

After this, all that remains is to provide the data bank card(The Federal Tax Service does not cooperate with all banks).

A legal entity can also pay taxes on the Federal Tax Service website after the necessary reporting has been submitted.Moreover, it does not matter whether there is a periodic payment or whether debts are paid due to what happened.

Video: how to pay taxes online

Important! There are many services that offer to pay taxes using an INN. But you need to take into account that some of them may have nothing to do with the Federal Tax Service and payments will not reach their destination. It is advisable to use official resources.Through State Services

As mentioned above, through State Services you can check the presence of tax debts. In addition, other mandatory contributions are also displayed during the check.

If a debt is identified, payment can be made immediately. To do this, choose payment:

- using a Visa or MasterCard bank card;

- through the Webmoney payment service.

You can also simply print out a receipt and pay in cash through any bank.

Is it possible to pay taxes through Sberbank Online

If you are a client of Sberbank and have a plastic card from this bank, you can pay taxes through Sberbank Online. Payment is debited from the card account.

For translation you will need:

- availability of the required amount on the card account;

- Internet access (computer, mobile device).

When you first visit the Sberbank Online service, you will need to register (card details will be required).

If for some reason you don’t have it at hand at the time of payment, you can check the availability of taxes through Sberbank Online by selecting the “Tax Search” section.

The system, through the Federal Tax Service, will check for the presence of debt and, if unpaid payments are identified, will offer to pay them.

By document index

If you have a receipt for paying taxes, payment can be made using the document index through any bank that cooperates with the tax authorities.

Using Sberbank as an example, the procedure will be as follows:

- Login to personal account.

- Select the “Select a service” section.

- Click on the item “Payment of tax by document index”.

- The top line of the form that opens indicates the index of the document from the receipt.

- After the details and payment amount appear, you need to check the data with the existing receipt.

- Confirm the transaction with the password received via SMS.

The document index (UIN) is a unique number of the accrued tax. Under this number, information about the amount of tax and taxpayer data is stored in a special database.

Banks have access to this database. Therefore, when you enter an index, reliable tax data is displayed in the electronic payment system. There is no need to worry that the tax amount or payment purpose will be indicated incorrectly.

By bank card without commission

When paying taxes through payment systems, you will also have to pay a fee for making the payment.

Also, a commission is charged when paying with bank cards using a receipt through the Internet banking of banks that are not partners of the Federal Tax Service.

To pay taxes without commission, you should use the Federal Tax Service “Pay Tax” service. In this case, only the tax amount is charged from the bank card.

No commission is charged when using a card from a partner bank. The partners of the Federal Tax Service are 16 banks, including Sberbank, Gazprombank, Promsvyazbank and others.

At the same time, you can pay taxes without commission either through the taxpayer’s personal account or using the “Payment of taxes for individuals” service.

What to do if you haven’t received a receipt

Can I pay taxes without a receipt? For example, how to pay land tax if there is no receipt or other property tax?

If a receipt for payment has not been received from the Federal Tax Service, most likely it has been uploaded to the taxpayer’s account on the Federal Tax Service website or the State Services portal.

When there is no receipt there, you should check with the tax office (in person or by phone) whether the payments were sent out and whether there was a system failure.

But the absence of a receipt, including loss, does not prevent the payment of taxes. In fact, a receipt is only required when paying in cash through a bank.

In other cases, you can simply check the availability of taxes on the website of the State Services or the Federal Tax Service, through Sberbank Online.

In addition, the Yandex.Money system offers the ability to check taxes by TIN. Knowing the amount to be paid, you can pay the tax online using your TIN and without a receipt.

Is it necessary to pay taxes on time? Upon expiration of the tax payment period, a penalty is charged. If payment is ignored, the case is referred to the court and then to the FSSP.

In this case, the court imposes a fine on the taxpayer, and bailiffs may demand payment of the costs of enforcement proceedings.

As a result, you will still have to pay the tax (possibly through confiscation of property) and in a significantly larger amount.

Recently in electronic format A lot of information is obtained and processed on various Internet resources. It is not surprising that the opportunity to do all sorts of things has now become available. electronic revolutions Money and often do so without commission.

It's not just about shopping online, but also about paying for utilities and other services. Payments for various taxes have recently been added to this list.

The most important advantage of paying various payments via the Internet is speed. In second place is the absence of the need to leave the house, waste time on the way to the tax office, and also standing in long queues.

Most people put off paying taxes until the last minute precisely because they do not want to or do not have enough time to wait tediously. Paying online solves this issue in no longer than two to three minutes. In addition, there are several other important advantages of remote funds transfer:

- Safety. The systems that carry out the transfer of funds are completely confidential, which guarantees that the payment will be received in the correct bank account.

- Availability. You can pay the tax at any time of the day and on any day, including holidays.

Who can pay what taxes online?

There are several types of tax payments that are subject to remote payment:

- Transport tax or as it is otherwise called - the vehicle tax.

- Property tax.

- Land tax(standard tax on land property).

- Income tax(Form 2-NDFL).

The ability to pay taxes online is provided to all individuals who are taxpayers. Also, individual entrepreneurs and LLCs can make payments.

Description of the service on the Federal Tax Service website

Not long ago, a service was opened on the website of the Federal Tax Service, allowing individuals to pay taxes on time.

Not long ago, a service was opened on the website of the Federal Tax Service, allowing individuals to pay taxes on time.

It has a clear and even basic interface, which simplifies the payment process, ensuring that there are no problems with searching and entering information.

The Federal Tax Service service allows taxpayers to create receipts for future payment of land, property or transport tax before receiving the official ENU (unified tax notice).

Also, it is possible to create payments for income tax for individuals and payments for all kinds of fines if the tax service was not submitted in a timely manner certificate 3-NDFL.

The same service provides the opportunity to generate various receipts for debts of individuals and print them out for subsequent payment in any organization in cash or make payments in special online systems of well-known banks, whose managers have entered into an agreement with the Federal Tax Service.

Step-by-step instructions for remote tax payment

For individuals

Surprisingly, it is for individuals that access to sending a payment report to the tax service is prohibited. They can pay off the debt, but they will still have to visit the tax office to provide a payment receipt, which can be printed after the payment is made.

To pay, you should visit one of the services described below. Let's look at a few examples of payment in two different payment systems: Sberbank Online And Yandex. Money.

For those who own a Sberbank bank card, the first option is suitable, since when you issue it you need to go through an easy registration in your personal account of the system in order to receive a login and password for further use (the ID can only be obtained at Sberbank ATMs).

For Sberbank clients

- We enter the service account on the Sberbank of Russia website.

- Select the column “Payments and transfers”, then “All payments and transfers”, and then “Federal Tax Service”.

- Next, several fields will open for entering confidential information, for example, the document index. You must enter a combination of index numbers.

- An SMS message with a one-time password, which is generated individually for each person, will be sent to the user’s phone number and is a confirmation of payment.

There is a certain regional system, which provides templates for paying taxes. It is considered one of the most difficult, since it requires entering all the details, in which it is easy not only for a novice, but also for an experienced user.

For users of the Yandex.Money resource

- You need to open the official Yandex.Money website.

- Click “Pay Receipt”.

- In the window that opens, select all the necessary payment values: type, type, region, name of the tax authority and OKATO.

- We indicate your full name and actual place of residence. If the place of registration and place of residence are different, then it is necessary to indicate only the place that is your place of residence at the time of the transaction.

- In the line that opens, enter the amount required for payment. It should be entered taking into account commission fees (the percentage is indicated in small font below the input line), as a rule, this is no more than 30 rubles for the average payment.

- We confirm the payment.

For individual entrepreneurs

- We visit the Federal Tax Service website.

- After selecting an operation (payment type), the site redirects the user to the page of the services with which the agreement was concluded (consider Sberbank).

- You must log into your personal account by entering your username and password.

- Select the item “Payments and transfers”, then – “All payments and transfers”.

- Next, you need to select the desired tax service. You should carefully enter the recipient’s details and your own, and also have a sufficient amount on your bank card account.

- The recipient can be found by both full name and TIN.

- We confirm the payment with a blue electronic seal.

- Enter in the window that opens one-time password from an SMS message.

- Information should appear on the screen indicating that the payment was successfully completed.

You can view and track the payment in your Sberbank online personal account. It is also possible to print a payment receipt.

For legal entities

For legal entities The principle of remote payment of taxes is similar to the method for individual entrepreneurs. The only difference is the choice of tax or contribution and the amount to pay.

In general, for individual entrepreneurs and LLCs, online payment on the Internet is in a convenient way saving time. The system automatically sends a payment report to the tax service, which fully resolves the issue of downtime in tax inspection queues.

Video: Instructions for using the Federal Tax Service service

A step-by-step guide for users who want to use the tax website.